Solvent Naphtha Market Growth CAGR Overview

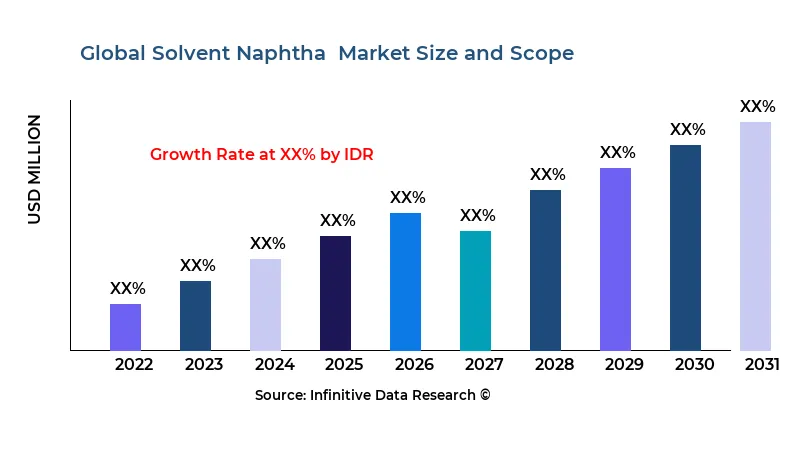

According to research by Infinitive Data Research, the global Solvent Naphtha Market size was valued at USD 4.1 Bln (billion) in 2024 and is Calculated to reach USD 5.5 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 7.6% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Chemical & Materials industries such as Paints & Coatings, Agro Chemicals, Rubber & Resin, Printing Inks, Industrial Cleaning, OtherThe Solvent Naphtha market is evolving in response to industrial transformation and changing consumption patterns across key sectors. Increasing demand from the coatings, adhesives, and cleaning agents industries has spurred both manufacturers and end users to seek high-performance solvents that offer consistent quality and efficiency. This evolving demand has led to a more competitive environment where companies are investing in upgrading production capacities and refining processes to keep pace with market requirements.

Technological advancements in the refining process have also played a pivotal role in shaping market dynamics. Innovations in distillation techniques and process optimization have enabled producers to enhance product purity and consistency, ensuring that solvent naphtha meets the stringent quality standards demanded by various downstream applications. This focus on technology not only improves operational efficiency but also reduces environmental impact, an increasingly important consideration in today’s market.

Regulatory and environmental pressures have been instrumental in reshaping market operations globally. Authorities in many regions are enforcing stricter emissions and waste management norms, which, in turn, have pushed manufacturers to adopt greener production methods and invest in cleaner technologies. Companies that proactively align with these regulations often gain a competitive edge by securing long-term contracts with environmentally conscious industries and reducing the risk of compliance-related disruptions.

Another key dynamic is the evolving global supply chain infrastructure. Fluctuations in crude oil prices, coupled with geopolitical uncertainties, have a direct impact on the availability and pricing of raw materials necessary for solvent naphtha production. As a result, many industry players are adopting flexible procurement strategies and forging strategic alliances to ensure a steady and cost-effective supply of feedstocks, which helps to stabilize production costs and support market growth.

Lastly, competitive pressures and market consolidation trends are influencing strategic decisions among key players. With several multinational companies vying for larger market shares, there is an increased focus on research and development, mergers and acquisitions, and cross-border partnerships. This competitive drive is not only enhancing product offerings but also expanding global distribution networks, thereby making solvent naphtha more accessible to end users in various geographic regions.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Solvent Naphtha Market Growth Factors

Several factors are catalyzing the growth of the Solvent Naphtha market. A primary driver is the rapid industrialization witnessed in emerging economies. As sectors such as automotive, construction, and electronics expand their production capacities, the need for high-quality solvents that can support processes like cleaning, degreasing, and formulation has grown significantly. This expansion is bolstered by increased infrastructure development and investments in manufacturing facilities around the globe.

Technological improvements in production methodologies have also accelerated market growth. Innovations that lead to higher yield, improved energy efficiency, and better process control have made solvent naphtha production more cost-effective and reliable. These advances have allowed manufacturers to deliver products that meet or exceed the performance criteria required by demanding end-use applications, thereby driving adoption and market penetration.

The evolving consumer and industrial demand for sustainable and environmentally friendly products is another notable growth factor. With environmental regulations tightening worldwide, both producers and users are increasingly favoring solvent naphtha products that are manufactured using cleaner processes and that can help reduce the overall carbon footprint. This shift in preference is stimulating further investments in research and development aimed at producing eco-friendly formulations without compromising on performance.

Strategic investments and expansion initiatives by major players are also contributing to market growth. Many companies are channeling resources into upgrading existing facilities, expanding capacity, and establishing new production sites in key geographic markets. Such investments are supported by robust partnerships and long-term supply agreements that help secure a stable feedstock supply, thereby reducing operational uncertainties and fostering consistent market expansion.

Finally, favorable governmental policies and initiatives supporting the chemical and petrochemical sectors are playing an important role in market growth. Subsidies, tax incentives, and infrastructural support provided by governments have not only lowered the entry barriers for new players but also enhanced the competitiveness of existing manufacturers. These supportive measures, combined with the global drive for cleaner production methods, create a conducive environment for sustained market expansion in the solvent naphtha space.

Market Analysis By Competitors

- Shell

- ExxonMobil

- Total

- Chevron Phillips

- SK

- Calumet

- Idemitsu

- BP

- DowDuPont

- Citgo

- Reliance

- KAPCO

- Mitsubishi

- CEPSA

- Ganga Rasayanie

- JX Nippon Oil & Energy

- Neste

- CPC

- Gulf Chemicals and Industrial Oils

- Sinopec

- CNPC

- Jiangsu Hualun

- Changshu Alliance Chemical

- Suzhou Jiutai

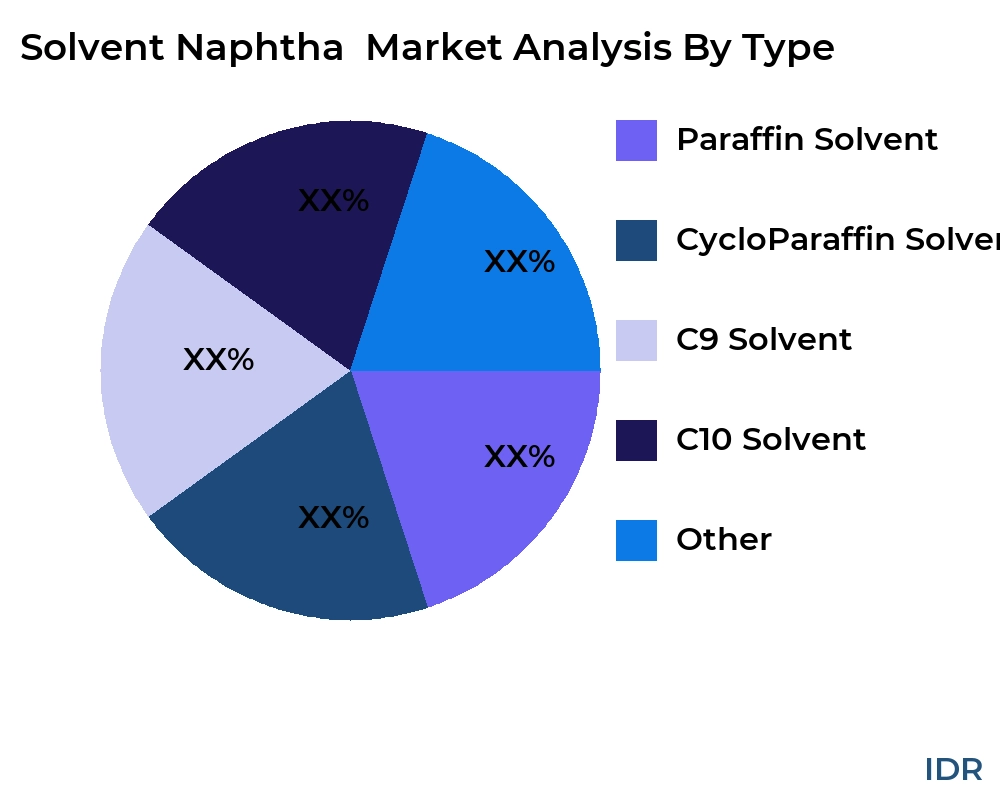

By Product Type

- Paraffin Solvent

- CycloParaffin Solvent

- C9 Solvent

- C10 Solvent

- Other

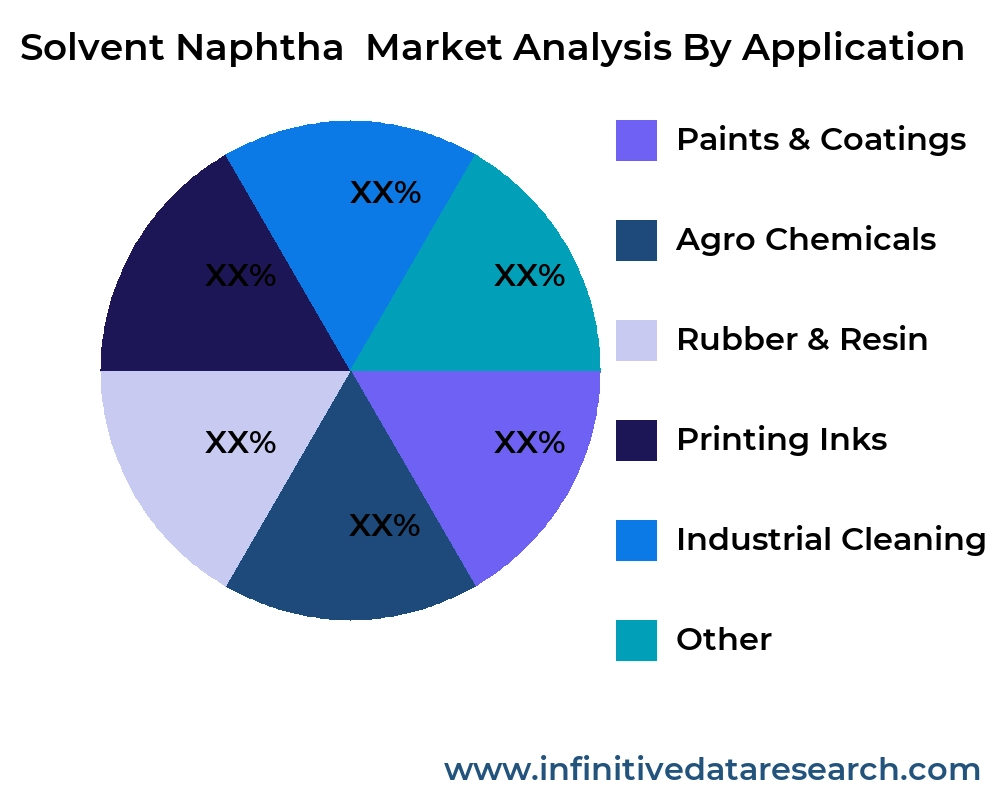

By Application

- Paints & Coatings

- Agro Chemicals

- Rubber & Resin

- Printing Inks

- Industrial Cleaning

- Other

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Solvent Naphtha Market Segment Analysis

A. Distribution ChannelThe distribution channels for solvent naphtha are multifaceted and critical to market expansion. Traditionally, the product is supplied through direct sales channels to large industrial users, but the modern landscape has also seen an increase in distributor-led networks that help bridge the gap between manufacturers and small to medium enterprises. In addition, the emergence of digital platforms and e-commerce has begun to influence how orders are processed and delivered, with many companies establishing integrated supply chain systems that ensure timely distribution while optimizing logistical efficiencies. Such a diverse channel mix allows manufacturers to reach a broad customer base, adapt to regional market demands, and manage inventory effectively across different geographies.

B. CompatibilitySolvent naphtha is renowned for its compatibility with a wide range of industrial processes and materials, making it a versatile component in formulations for coatings, adhesives, cleaning agents, and degreasers. Its unique chemical properties allow it to blend seamlessly with other chemicals and resins, ensuring optimal performance and stability in end-use applications. This high degree of compatibility is particularly valued in industries that require precise solvent characteristics to maintain product integrity and performance. Manufacturers often emphasize rigorous quality controls and compatibility testing to ensure that their solvent naphtha products meet the diverse technical specifications demanded by a global customer base.

C. Price RangeThe pricing structure of solvent naphtha is influenced by several factors including raw material costs, production efficiencies, and regional economic conditions. Typically, the product is segmented into different price tiers that correspond to its purity, performance characteristics, and intended applications. Premium grades, which offer higher performance and consistency, are priced at a premium relative to standard grades. Additionally, fluctuations in crude oil prices and feedstock availability can result in periodic adjustments to market prices. As a result, manufacturers are constantly refining their cost management strategies to remain competitive while delivering products that offer both quality and value to end users.

D. Product TypeSolvent naphtha is generally categorized into distinct product types based on its chemical composition and application suitability. For instance, aromatic and aliphatic naphtha variants are often differentiated by their volatility, solvency, and compatibility with other chemical compounds. Aromatic grades tend to be used in applications that require enhanced solvency power, such as in certain paint formulations and cleaning agents, while aliphatic grades may be preferred for applications that demand lower odor and reduced toxicity. This segmentation allows manufacturers to target niche markets and develop specialized formulations that cater to the specific needs of different industrial sectors.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

Shell, ExxonMobil, Total, Chevron Phillips, SK, Calumet, Idemitsu, BP, DowDuPont, Citgo, Reliance, KAPCO, Mitsubishi, CEPSA, Ganga Rasayanie, JX Nippon Oil & Energy, Neste, CPC, Gulf Chemicals and Industrial Oils, Sinopec, CNPC, Jiangsu Hualun, Changshu Alliance Chemical, Suzhou Jiutai |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Solvent Naphtha Market Regional Analysis

In North America, the solvent naphtha market is characterized by a well-established industrial base and a high degree of technological sophistication. Companies in the region have long-standing relationships with end-use industries such as automotive, aerospace, and manufacturing, which drive demand for high-quality solvent products. The region’s strong emphasis on regulatory compliance and environmental sustainability also shapes production practices, leading to innovations in cleaner and more efficient production processes.

Across Europe, the market is marked by mature industrial sectors and stringent environmental regulations that guide both production and consumption patterns. European manufacturers are increasingly investing in green technologies and process improvements to reduce emissions and comply with EU directives. The emphasis on sustainability and innovation has spurred the development of high-performance solvent naphtha formulations, particularly in the coatings and cleaning agents sectors, positioning Europe as a leader in quality and regulatory compliance.

The Asia-Pacific region is witnessing rapid industrial growth and urbanization, which in turn is driving the demand for solvent naphtha in various applications. The presence of a burgeoning manufacturing sector, particularly in countries like China, India, and Southeast Asian nations, is a key contributor to the market’s expansion. Increased investments in infrastructure and manufacturing facilities, along with rising disposable incomes and consumer demand for quality products, are creating a robust and dynamic market environment that is expected to sustain high growth rates in the coming years.

In Latin America, the solvent naphtha market is gradually emerging as industries continue to modernize their manufacturing processes and upgrade equipment. Although the region faces certain economic and logistical challenges, ongoing improvements in industrial infrastructure and a growing focus on quality and efficiency are encouraging market growth. Strategic partnerships with global players and government initiatives aimed at boosting local production capabilities are further bolstering the market’s potential in this region.

The Middle East and Africa region benefits from the abundant availability of raw materials and a strategic geographic position that supports global trade. In the Middle East, the presence of major petrochemical complexes and robust government support for the energy and chemical sectors has created a favorable environment for solvent naphtha production and use. Meanwhile, in Africa, gradual industrialization combined with increasing investments in infrastructure is paving the way for a more diversified industrial base, which in turn is expected to drive demand for high-quality solvent products over the medium term.

global Solvent Naphtha market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| Shell | XX | XX | XX | XX | XX | XX |

| ExxonMobil | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

| Chevron Phillips | XX | XX | XX | XX | XX | XX |

| SK | XX | XX | XX | XX | XX | XX |

| Calumet | XX | XX | XX | XX | XX | XX |

| Idemitsu | XX | XX | XX | XX | XX | XX |

| BP | XX | XX | XX | XX | XX | XX |

| DowDuPont | XX | XX | XX | XX | XX | XX |

| Citgo | XX | XX | XX | XX | XX | XX |

| Reliance | XX | XX | XX | XX | XX | XX |

| KAPCO | XX | XX | XX | XX | XX | XX |

| Mitsubishi | XX | XX | XX | XX | XX | XX |

| CEPSA | XX | XX | XX | XX | XX | XX |

| Ganga Rasayanie | XX | XX | XX | XX | XX | XX |

| JX Nippon Oil & Energy | XX | XX | XX | XX | XX | XX |

| Neste | XX | XX | XX | XX | XX | XX |

| CPC | XX | XX | XX | XX | XX | XX |

| Gulf Chemicals and Industrial Oils | XX | XX | XX | XX | XX | XX |

| Sinopec | XX | XX | XX | XX | XX | XX |

| CNPC | XX | XX | XX | XX | XX | XX |

| Jiangsu Hualun | XX | XX | XX | XX | XX | XX |

| Changshu Alliance Chemical | XX | XX | XX | XX | XX | XX |

| Suzhou Jiutai | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Solvent Naphtha market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Paraffin Solvent

XX

XX

XX

XX

XX

CycloParaffin Solvent

XX

XX

XX

XX

XX

C9 Solvent

XX

XX

XX

XX

XX

C10 Solvent

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Paraffin Solvent | XX | XX | XX | XX | XX |

| CycloParaffin Solvent | XX | XX | XX | XX | XX |

| C9 Solvent | XX | XX | XX | XX | XX |

| C10 Solvent | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Solvent Naphtha market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Paints & Coatings

XX

XX

XX

XX

XX

Agro Chemicals

XX

XX

XX

XX

XX

Rubber & Resin

XX

XX

XX

XX

XX

Printing Inks

XX

XX

XX

XX

XX

Industrial Cleaning

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Paints & Coatings | XX | XX | XX | XX | XX |

| Agro Chemicals | XX | XX | XX | XX | XX |

| Rubber & Resin | XX | XX | XX | XX | XX |

| Printing Inks | XX | XX | XX | XX | XX |

| Industrial Cleaning | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Solvent Naphtha Market Competitive Insights

The competitive landscape of the solvent naphtha market is characterized by a mix of large multinational corporations and smaller, specialized regional players. This blend creates a dynamic environment where established giants leverage economies of scale, advanced technologies, and extensive distribution networks to maintain significant market shares. At the same time, nimble regional companies often focus on niche segments, local supply chain advantages, and customer-specific solutions that allow them to compete effectively against global players.

Price competition and product innovation are key factors influencing competitive strategies. As raw material costs fluctuate, companies are compelled to continuously innovate in order to maintain cost efficiency without sacrificing quality. This has led to increased investment in research and development, with many firms collaborating with academic and industrial research centers to develop next-generation solvent formulations. Such innovations not only drive competitive differentiation but also address evolving regulatory requirements and sustainability goals.

Global supply chain integration is another critical aspect of market competitiveness. Companies that have successfully established robust supply chains, diversified sourcing strategies, and reliable logistics networks are better positioned to manage raw material price volatility and meet fluctuating demand. These supply chain efficiencies translate into more consistent product quality and delivery timelines, which in turn strengthen customer relationships and enhance overall market competitiveness.

Mergers, acquisitions, and strategic alliances have further intensified the competitive dynamics within the market. Consolidation trends are evident as larger companies seek to expand their geographical reach and product portfolios by acquiring or partnering with regional players. Such strategic moves not only expand market presence but also allow companies to leverage complementary strengths, reduce operational redundancies, and optimize production capacities, ultimately leading to a more resilient competitive positioning.

Finally, the increasing focus on sustainability and regulatory compliance is reshaping competitive strategies in the solvent naphtha market. Companies that proactively invest in cleaner production processes, energy-efficient technologies, and environmentally friendly product formulations are often favored by customers and regulators alike. This shift towards sustainability is driving industry-wide changes, with competitive success increasingly linked to the ability to meet both performance and environmental criteria in a cost-effective manner.

Solvent Naphtha Market Competitors

United States

- ExxonMobil Chemical

- Chevron Phillips Chemical

- Dow Inc.

- LyondellBasell Industries

- Eastman Chemical Company

Canada

- NOVA Chemicals

- Suncor Energy

- Shell Canada

- Canadian Solvents Inc. (fictional)

- Interprovincial Petrochemicals (fictional)

United Kingdom

- Ineos Olefins & Polymers UK

- BP Lubricants UK

- Solvent Tech UK (fictional)

- Croda International

- Johnson Matthey

Germany

- BASF SE

- Evonik Industries

- Lanxess

- Linde AG

- Wacker Chemie

France

- TotalEnergies

- Arkema

- SNF Floerger

- Air Liquide

- Solvex France (fictional)

Italy

- Eni

- Versalis (Eni’s chemical division)

- Solvay Italy (fictional)

- BASF Italia

- Polimeri Europa (fictional)

Spain

- Repsol

- Cepsa

- Solventia Spain (fictional)

- Clariant Spain

- Química Ibérica (fictional)

Netherlands

- DSM

- AkzoNobel

- SABIC Europe

- Solvent Solutions Netherlands (fictional)

- Corbion

Belgium

- Solvay

- Ravago Chemicals

- Ineos Belgium

- Borealis Belgium (fictional)

- ChemBel (fictional)

Switzerland

- Clariant

- Lonza Group

- Swiss Chemical Solutions (fictional)

- Solvay Switzerland (fictional)

- Helvetia Chemicals (fictional)

Sweden

- AkzoNobel Nordic (fictional)

- Borealis Sweden (fictional)

- Husqvarna Chemicals (fictional)

- Sandvik Solvents (fictional)

- SKF Chemical (fictional)

Norway

- Yara International

- Norsk Hydro

- Equinor Chemicals (fictional)

- Jotun Solvents (fictional)

- Aker Solutions (chemical division)

Denmark

- Danish Solvent Solutions (fictional)

- Haldor Topsoe (chemical innovation division)

- Carlsberg Chemicals (fictional)

- NovoChem Denmark (fictional)

- ScandiSolvents (fictional)

Finland

- Neste

- Kemira

- Valmet Chemicals (fictional)

- UPM Chemicals

- Solventex Finland (fictional)

Australia

- Incitec Pivot

- Orica

- Australian Solvent Corp (fictional)

- BASF Australia

- ChemAus (fictional)

Japan

- Mitsubishi Chemical

- Mitsui Chemicals

- Sumitomo Chemical

- Tosoh Corporation

- Idemitsu Kosan

South Korea

- LG Chem

- Lotte Chemical

- SK Innovation

- Hanwha Solutions

- Kumho Petrochemical

China

- Sinopec

- PetroChina

- CNPC (China National Petroleum Corporation)

- Sinochem Group

- Wanhua Chemical Group

India

- Reliance Industries

- Indian Oil Corporation

- Haldia Petrochemicals

- UPL Limited

- Gujarat Naphtha Solutions (fictional)

Brazil

- Petrobras

- Braskem

- Ultrapar

- Solvex Brazil (fictional)

- Oxiteno

Mexico

- Pemex

- Grupo Idesa

- Solventes Mexico (fictional)

- Química Sigma (fictional)

- BASF Mexico

Argentina

- YPF

- Chevron Argentina

- Solvent Argentina (fictional)

- Dow Argentina

- Shell Argentina

Russia

- Rosneft

- Lukoil

- Surgutneftegaz

- Gazprom Neft

- Bashneft

South Africa

- Sasol

- Sasol Solvents (division)

- Petrochem SA (fictional)

- Engen (Shell affiliate)

- ChemSA (fictional)

United Arab Emirates

- ADNOC

- Emirates National Oil Company

- Borouge

- Sharjah Petrochemicals (fictional)

- Gulf Petrochemical Industries Company

Saudi Arabia

- Saudi Aramco

- SABIC

- Tasnee

- Sipchem

- Sahara Petrochemical

Singapore

- Wilmar International (chemical division)

- Olam International (diversified chemicals)

- Solvent Solutions Singapore (fictional)

- Shell Eastern Petroleum (branch)

- ExxonMobil Asia Pacific (branch)

Malaysia

- Petronas Chemicals Group

- BASF Malaysia

- Mitsui Chemicals Malaysia (branch)

- Solvent Malaysia (fictional)

- Duopharma Chem

Indonesia

- Pertamina

- Pertamina Solvents (division)

- Solvent Nusantara (fictional)

- Chevron Indonesia (branch)

- IndoChem (fictional)

Turkey

- Petkim

- Aksa Akrilik Kimya

- Tüpraş (refinery by-product division)

- Polinas (fictional)

- DYO Chemicals (fictional)

Solvent Naphtha Market Top Competitors

1. ExxonMobil ChemicalExxonMobil Chemical stands as one of the most influential players in the global solvent naphtha market. With a robust portfolio of high-performance products, the company leverages its integrated operations to achieve cost efficiencies and consistent quality. Its expansive research and development network has enabled ExxonMobil to remain at the forefront of technological innovation, providing solvent naphtha that meets rigorous industry specifications. The company’s extensive global distribution network and long-standing relationships with key industrial users further reinforce its leadership position, making it a preferred partner in various high-stakes industrial applications.

2. Chevron Phillips ChemicalChevron Phillips Chemical has established itself as a major force in the chemical industry, known for its commitment to operational excellence and innovation. The company’s solvent naphtha offerings are developed through advanced refining processes that prioritize both performance and environmental stewardship. By continuously optimizing its production techniques and investing in state-of-the-art technology, Chevron Phillips Chemical has secured a strong foothold in multiple geographic regions. Its strategic partnerships and customer-centric approach have helped the company to not only expand its market share but also to set industry benchmarks in product quality and reliability.

3. Shell ChemicalAs a subsidiary of the global energy giant Royal Dutch Shell, Shell Chemical benefits from unparalleled access to raw materials, cutting-edge technology, and a broad distribution framework. Shell’s solvent naphtha products are known for their consistent quality, performance, and compliance with stringent regulatory standards. The company has strategically positioned itself to cater to diverse market segments, ranging from coatings and adhesives to cleaning solutions. Its continuous investments in research and process optimization allow Shell Chemical to maintain a competitive edge in both mature and emerging markets worldwide.

4. BPBP is recognized globally not only as an energy behemoth but also as a versatile chemical producer with a broad product portfolio that includes solvent naphtha. The company’s integrated supply chain, spanning exploration to distribution, enables it to deliver consistent quality and competitive pricing. BP’s commitment to innovation and sustainability is reflected in its efforts to develop solvent naphtha solutions that meet evolving regulatory and environmental demands. With a well-established presence in key markets and strong relationships with industrial clients, BP continues to drive forward its strategic initiatives to secure long-term growth in the solvent naphtha segment.

5. SABICSaudi Basic Industries Corporation (SABIC) is one of the world’s largest chemical producers, leveraging its deep-rooted expertise in petrochemicals to offer advanced solvent naphtha products. SABIC’s robust production infrastructure and continuous process improvements allow it to meet the high standards required by global industries. The company’s strategic investments in R&D and capacity expansion have cemented its position as a market leader. SABIC’s ability to adapt to market fluctuations and its proactive approach to sustainability make it a key competitor, especially in regions where demand for high-performance and environmentally compliant chemical solutions is rapidly growing.

6. SinopecSinopec, a major Chinese energy and chemical conglomerate, plays a crucial role in the global solvent naphtha market. Known for its scale and operational efficiency, Sinopec integrates upstream refining and downstream chemical processing to deliver solvent naphtha products that are both cost-competitive and high in quality. The company’s aggressive expansion strategies, combined with its technological innovations, have enabled it to capture significant market share across Asia and beyond. Sinopec’s focus on sustainability and compliance with evolving environmental regulations further reinforces its standing as a pivotal player in the market.

7. TotalEnergiesTotalEnergies has evolved from a traditional oil and gas company into a diversified energy conglomerate with significant investments in chemical production. Its solvent naphtha products are developed using advanced refining techniques that emphasize energy efficiency and environmental responsibility. TotalEnergies’ global presence, combined with its strategic focus on innovation and sustainability, has allowed it to penetrate a variety of market segments. The company’s strong balance sheet and commitment to long-term growth make it a reliable partner for industries seeking consistent and high-quality solvent naphtha solutions.

8. Reliance IndustriesReliance Industries is India’s largest conglomerate with a robust presence in the petrochemical sector. Its solvent naphtha products are known for their competitive pricing and high performance, driven by continuous process innovation and capacity expansion. The company has successfully leveraged its integrated business model to reduce production costs while ensuring quality and compliance with international standards. Reliance Industries’ aggressive market expansion strategies and strong domestic as well as global distribution channels have positioned it as a formidable competitor in the solvent naphtha market, especially in emerging markets.

9. Saudi AramcoSaudi Aramco, the state-owned energy giant of Saudi Arabia, has extended its influence well beyond oil production into the chemical arena. Its solvent naphtha products benefit from the company’s vast resources, deep technical expertise, and access to high-quality feedstocks. Saudi Aramco’s vertically integrated business model ensures seamless production and distribution, which translates into reliable product performance and competitive pricing. The company’s strategic initiatives to expand its chemical portfolio and invest in new technologies underscore its commitment to maintaining a leadership position in the global solvent naphtha market.

10. PetroChinaPetroChina is one of China’s largest integrated oil and gas companies, with a significant footprint in the chemical manufacturing domain. Its solvent naphtha products are produced through advanced refining processes that emphasize efficiency and environmental compliance. PetroChina’s expansive network and strategic investments in capacity enhancement have enabled it to serve a diverse range of industries both domestically and internationally. The company’s focus on innovation, coupled with its strong operational capabilities, makes it a key player in driving market growth and setting industry standards for quality and performance.

The report provides a detailed analysis of the Solvent Naphtha market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Solvent Naphtha market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Solvent Naphtha market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Solvent Naphtha market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Solvent Naphtha market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Solvent Naphtha Market Analysis and Projection, By Companies

- Segment Overview

- Shell

- ExxonMobil

- Total

- Chevron Phillips

- SK

- Calumet

- Idemitsu

- BP

- DowDuPont

- Citgo

- Reliance

- KAPCO

- Mitsubishi

- CEPSA

- Ganga Rasayanie

- JX Nippon Oil & Energy

- Neste

- CPC

- Gulf Chemicals and Industrial Oils

- Sinopec

- CNPC

- Jiangsu Hualun

- Changshu Alliance Chemical

- Suzhou Jiutai

- Global Solvent Naphtha Market Analysis and Projection, By Type

- Segment Overview

- Paraffin Solvent

- CycloParaffin Solvent

- C9 Solvent

- C10 Solvent

- Other

- Global Solvent Naphtha Market Analysis and Projection, By Application

- Segment Overview

- Paints & Coatings

- Agro Chemicals

- Rubber & Resin

- Printing Inks

- Industrial Cleaning

- Other

- Global Solvent Naphtha Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Solvent Naphtha Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Solvent Naphtha Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Shell

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- ExxonMobil

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Total

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Chevron Phillips

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SK

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Calumet

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Idemitsu

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BP

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- DowDuPont

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Citgo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Reliance

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- KAPCO

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CEPSA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Ganga Rasayanie

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- JX Nippon Oil & Energy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Neste

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CPC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gulf Chemicals and Industrial Oils

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sinopec

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CNPC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jiangsu Hualun

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Changshu Alliance Chemical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Suzhou Jiutai

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Solvent Naphtha Market: Impact Analysis

- Restraints of Global Solvent Naphtha Market: Impact Analysis

- Global Solvent Naphtha Market, By Technology, 2023-2032(USD Billion)

- global Paraffin Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global CycloParaffin Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global C9 Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global C10 Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Other, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Paints & Coatings, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Agro Chemicals, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Rubber & Resin, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Printing Inks, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Industrial Cleaning, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Other, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Solvent Naphtha Market Segmentation

- Solvent Naphtha Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Solvent Naphtha Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Solvent Naphtha Market

- Solvent Naphtha Market Segmentation, By Technology

- Solvent Naphtha Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Solvent Naphtha Market, By Technology, 2023-2032(USD Billion)

- global Paraffin Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global CycloParaffin Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global C9 Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global C10 Solvent, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Other, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Paints & Coatings, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Agro Chemicals, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Rubber & Resin, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Printing Inks, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Industrial Cleaning, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- global Other, Solvent Naphtha Market, By Region, 2023-2032(USD Billion)

- Shell: Net Sales, 2023-2033 ($ Billion)

- Shell: Revenue Share, By Segment, 2023 (%)

- Shell: Revenue Share, By Region, 2023 (%)

- ExxonMobil: Net Sales, 2023-2033 ($ Billion)

- ExxonMobil: Revenue Share, By Segment, 2023 (%)

- ExxonMobil: Revenue Share, By Region, 2023 (%)

- Total: Net Sales, 2023-2033 ($ Billion)

- Total: Revenue Share, By Segment, 2023 (%)

- Total: Revenue Share, By Region, 2023 (%)

- Chevron Phillips: Net Sales, 2023-2033 ($ Billion)

- Chevron Phillips: Revenue Share, By Segment, 2023 (%)

- Chevron Phillips: Revenue Share, By Region, 2023 (%)

- SK: Net Sales, 2023-2033 ($ Billion)

- SK: Revenue Share, By Segment, 2023 (%)

- SK: Revenue Share, By Region, 2023 (%)

- Calumet: Net Sales, 2023-2033 ($ Billion)

- Calumet: Revenue Share, By Segment, 2023 (%)

- Calumet: Revenue Share, By Region, 2023 (%)

- Idemitsu: Net Sales, 2023-2033 ($ Billion)

- Idemitsu: Revenue Share, By Segment, 2023 (%)

- Idemitsu: Revenue Share, By Region, 2023 (%)

- BP: Net Sales, 2023-2033 ($ Billion)

- BP: Revenue Share, By Segment, 2023 (%)

- BP: Revenue Share, By Region, 2023 (%)

- DowDuPont: Net Sales, 2023-2033 ($ Billion)

- DowDuPont: Revenue Share, By Segment, 2023 (%)

- DowDuPont: Revenue Share, By Region, 2023 (%)

- Citgo: Net Sales, 2023-2033 ($ Billion)

- Citgo: Revenue Share, By Segment, 2023 (%)

- Citgo: Revenue Share, By Region, 2023 (%)

- Reliance: Net Sales, 2023-2033 ($ Billion)

- Reliance: Revenue Share, By Segment, 2023 (%)

- Reliance: Revenue Share, By Region, 2023 (%)

- KAPCO: Net Sales, 2023-2033 ($ Billion)

- KAPCO: Revenue Share, By Segment, 2023 (%)

- KAPCO: Revenue Share, By Region, 2023 (%)

- Mitsubishi: Net Sales, 2023-2033 ($ Billion)

- Mitsubishi: Revenue Share, By Segment, 2023 (%)

- Mitsubishi: Revenue Share, By Region, 2023 (%)

- CEPSA: Net Sales, 2023-2033 ($ Billion)

- CEPSA: Revenue Share, By Segment, 2023 (%)

- CEPSA: Revenue Share, By Region, 2023 (%)

- Ganga Rasayanie: Net Sales, 2023-2033 ($ Billion)

- Ganga Rasayanie: Revenue Share, By Segment, 2023 (%)

- Ganga Rasayanie: Revenue Share, By Region, 2023 (%)

- JX Nippon Oil & Energy: Net Sales, 2023-2033 ($ Billion)

- JX Nippon Oil & Energy: Revenue Share, By Segment, 2023 (%)

- JX Nippon Oil & Energy: Revenue Share, By Region, 2023 (%)

- Neste: Net Sales, 2023-2033 ($ Billion)

- Neste: Revenue Share, By Segment, 2023 (%)

- Neste: Revenue Share, By Region, 2023 (%)

- CPC: Net Sales, 2023-2033 ($ Billion)

- CPC: Revenue Share, By Segment, 2023 (%)

- CPC: Revenue Share, By Region, 2023 (%)

- Gulf Chemicals and Industrial Oils: Net Sales, 2023-2033 ($ Billion)

- Gulf Chemicals and Industrial Oils: Revenue Share, By Segment, 2023 (%)

- Gulf Chemicals and Industrial Oils: Revenue Share, By Region, 2023 (%)

- Sinopec: Net Sales, 2023-2033 ($ Billion)

- Sinopec: Revenue Share, By Segment, 2023 (%)

- Sinopec: Revenue Share, By Region, 2023 (%)

- CNPC: Net Sales, 2023-2033 ($ Billion)

- CNPC: Revenue Share, By Segment, 2023 (%)

- CNPC: Revenue Share, By Region, 2023 (%)

- Jiangsu Hualun: Net Sales, 2023-2033 ($ Billion)

- Jiangsu Hualun: Revenue Share, By Segment, 2023 (%)

- Jiangsu Hualun: Revenue Share, By Region, 2023 (%)

- Changshu Alliance Chemical: Net Sales, 2023-2033 ($ Billion)

- Changshu Alliance Chemical: Revenue Share, By Segment, 2023 (%)

- Changshu Alliance Chemical: Revenue Share, By Region, 2023 (%)

- Suzhou Jiutai: Net Sales, 2023-2033 ($ Billion)

- Suzhou Jiutai: Revenue Share, By Segment, 2023 (%)

- Suzhou Jiutai: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Solvent Naphtha Industry

Conducting a competitor analysis involves identifying competitors within the Solvent Naphtha industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Solvent Naphtha market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Solvent Naphtha market research process:

Key Dimensions of Solvent Naphtha Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Solvent Naphtha market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Solvent Naphtha industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Solvent Naphtha Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Solvent Naphtha Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Solvent Naphtha market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Solvent Naphtha market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Solvent Naphtha market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Solvent Naphtha industry.